Trying to raise capital is going to be an uphill battle for SaaS businesses in 2023.

The good news is that many new debt providers have entered the market over the last few years, offering various structures and underwriting methods. That’s why I created this three part series meant to help SaaS operators (and VCs) sort through the different options in the market today.

(Part 2: Debt Structures Available to SaaS Companies in 2023)

(Part 3: Framework for Comparing Debt Options in SaaS)

But first—who am I to be handing out financial advice?

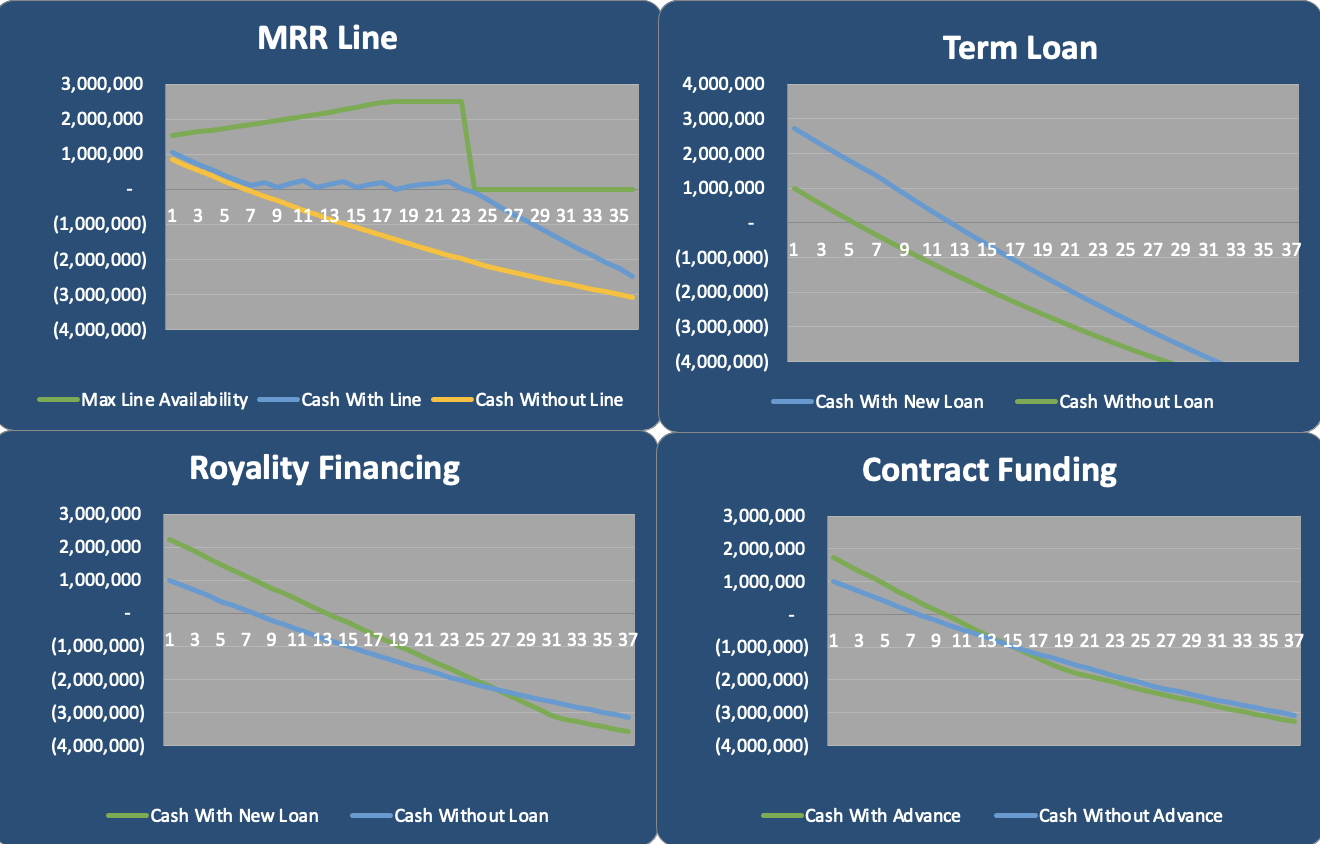

In addition to my direct lending experience in the SaaS space as the founder and long-time CEO of SaaS Capital, I have spent the last three months interviewing various capital providers to pull together an overview of the options in the market today. I have also built a loan analysis calculator to help you better understand the impact and nuances of the different structures outlined below.

You can download the loan analysis calculator here.

Who should borrow?

Let’s start by answering the fundamental question: should my SaaS company even borrow money?

The answer is different today than it was a year ago. The central role debt played in SaaS businesses over the last two decades was to fund growth (cash burn) between equity rounds. This dynamic allowed growing SaaS businesses and startups to raise future equity at a higher price. And because follow-on rounds were fairly easy to secure (and lenders were eager to refinance), no one thought too hard about the company itself having to repay the debt from cash flow.

With high valuations where one dollar of annual recurring revenue (ARR) was worth 15 to 20 dollars in enterprise value, the answer to “should I raise debt?” was almost always “yes” because virtually any level of growth increased the company’s valuation well in excess of the cost of the loan.

When does it make sense to take on debt?

Now that venture capital rounds are in short supply, the most appropriate use of debt in 2023 is to bridge a SaaS company to cash flow breakeven, not to the next equity round. In this context, debt is not always a good idea.

Debt should only be used in companies where higher future revenue will allow for an easier transition to breakeven (even considering debt service), and the company will exit the process larger and more stable than if it had not borrowed money.

In contrast, borrowing money to support the burn of a slow-growth business makes little sense. The company will exit the runway extension period provided by the debt with a similar level of monthly recurring revenue (MRR), and now because of debt service, even more significant expense cuts will need to be made to get to cash flow breakeven. Without growth, debt will only delay the path to cash flow breakeven. It’s wiser to bite the bullet sooner and not take on unnecessary debt that will make your financial situation worse.

How to make an accurate debt assessment

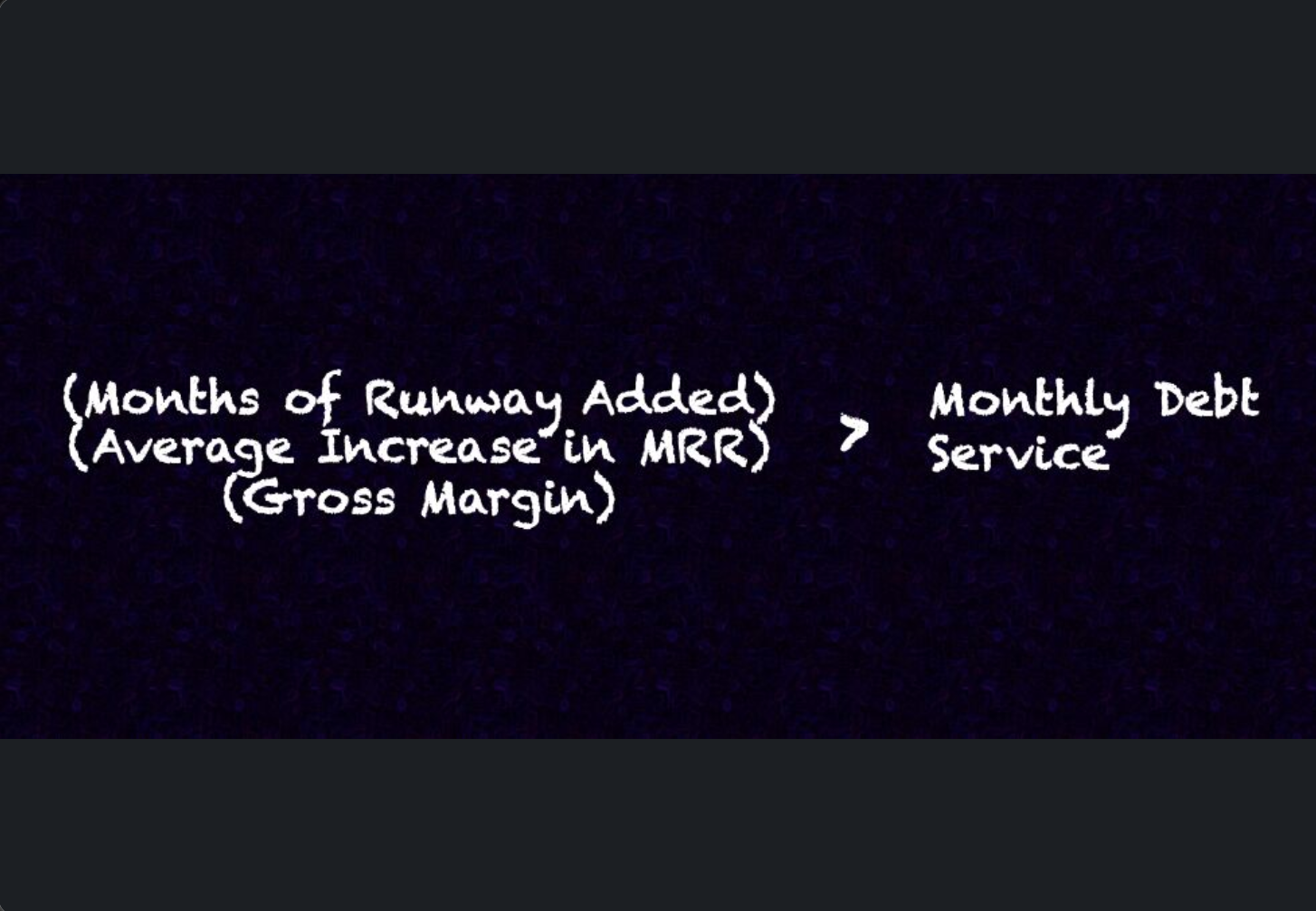

The minimum growth level needed for debt to add value is: (Incremental MRR*Gross Margin) > (Monthly Debt Service), where incremental MRR is the average monthly growth in MRR times the runway extension period (discussed below).

Another way to assess the appropriateness of debt is based on unit economics.

For example, suppose your CAC payback period is less than the amortization of the loan. In that case, you could borrow money, invest it in new customer acquisition, and then get paid from those customers before you repay the loan.

This theory holds for businesses otherwise operating at breakeven, where all the borrowed dollars are invested in higher sales and marketing spending. For companies operating at a loss, however, the unit economics may not have sufficient time to generate cash before the business runs out of money.

The other main factor that makes borrowing unattractive for a SaaS company is excessive churn. Gross retention rates near or below 80% make it difficult for the business to maintain growth without continually investing in sales and marketing. When (and if) sales and marketing budgets are cut to reach breakeven, SaaS businesses with poor retention will begin shrinking at a rate that makes debt service an increasingly impossible task.

In the capital-constrained environment of 2023, it’s essential to assume the business will repay the debt from future cash flow, and the company’s future growth rate will determine if raising debt will add value to your SaaS business or it will simply delay a transition to breakeven.

Can I Raise Debt?

Just like with equity, it’s more difficult to raise debt and secure funding now than it was 18 months ago; however, some standard criteria all lenders use will indicate potential success.

Because external equity is so scarce, cash runway is an essential underwriting hurdle in the market today. It will be hard to raise debt if your cash runway is already less than six months because lenders don’t want to fund borrowers who will immediately face a liquidity crisis. This is an unfortunate trend in underwriting because it tends to disqualify companies that would benefit most from the financing.

However, you can improve your chances of raising debt by focusing on these three key business areas:

1. Reduce expenses

If you want to improve your chances of SaaS financing by raising debt, you need to reduce your expenses, raise some internal equity, and then look to borrow money. Working on the issue from all three fronts will reduce the amount required from each process. Also, lenders are receptive to companies that are proactively working to solve their own problems. Finally, be sure to time the processes so the company is in-market for the debt the moment the equity raise is complete.

2. Improve retention

Retention has always been important, and lenders now look at net retention, gross retention, and logo retention. Therefore, have all your retention numbers accurate, detailed, and up-to-date before you begin conversations with lenders. Also, consider if specific cohort analysis might help better reflect future retention trends not discoverable in your metrics. That said, if your net retention is below 90%, you will need help clearing the underwriting process for most lenders.

3. Decrease your CAC payback period

Some newer lenders also focus on growth and customer acquisition efficiency (CAC payback) before offering SaaS funding. They want to ensure that the borrowed dollars can be converted into MRR quickly and efficiently. Specific targets vary by lender and ACV, but most lenders are looking for companies performing above average for their cohort when it comes to revenue growth and retention. Currently, a CAC payback of 16 months is about average; however, the metric is highly dependent on your ACV. You can benchmark your company by reviewing RevOps Squared’s 2022 SaaS Benchmarks Report.

Related to all of the above, some lenders are using the Rule of 40 as a lending criteria/screen. The Rule of 40 is the company’s annual growth rate plus its operating margin. And while “40” is in the name of the metric, that is a very aspirational benchmark, and most companies operate well below that level.

Finally, and as always, larger SaaS companies and those backed by institutional investors will have the easiest time raising debt. Companies below $50,000 in MRR have limited options in this market and would only find traction with the “contract financing” vendors referenced below.

Finding the best debt financing option for your SaaS company

Once you’ve determined whether or not raising debt makes sense for your company, it can still be difficult to wrap your head around the different kinds of debt structures that are available.

What kind of debt should we take on? Which debt structure will ultimately improve our financial position? How can we model out what cash burn will look like in the months following?

Using this loan analysis calculator, you can determine exactly how much debt you should raise, the debt structure that makes the most sense for your business (line of credit, term loan, revenue-based financing, equity financing, contract funding), and more.

You can access the complete loan analysis calculator here.