A few weeks ago, I compared Net Revenue Retention trends between consumption SaaS companies and subscription (primarily seat-based) SaaS companies.

The hypothesis was that usage would decline before headcount and annual renewals as the economy slows. Therefore, NRR for consumption business will suffer before that of seat-based or other subscription SaaS companies.

The data bore that out. The median NRR for usage-based companies declined ten percentage points in the third quarter, while subscription companies’ NRRs went up two percentage points.

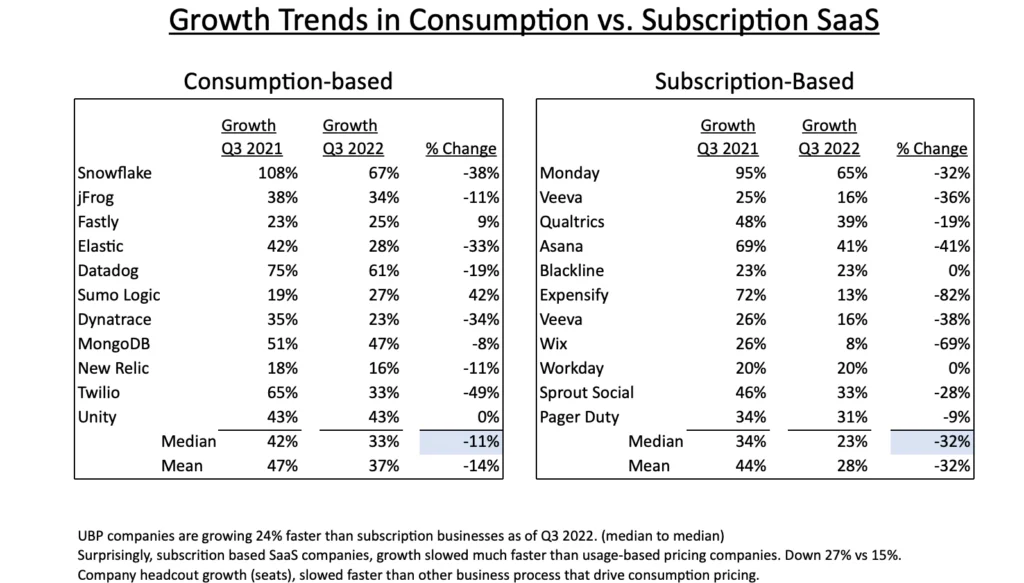

Since subscription companies did a better job renewing and growing their installed base of customers, it would be logical that their growth rates held up better too. The data does not support this assertion, however.

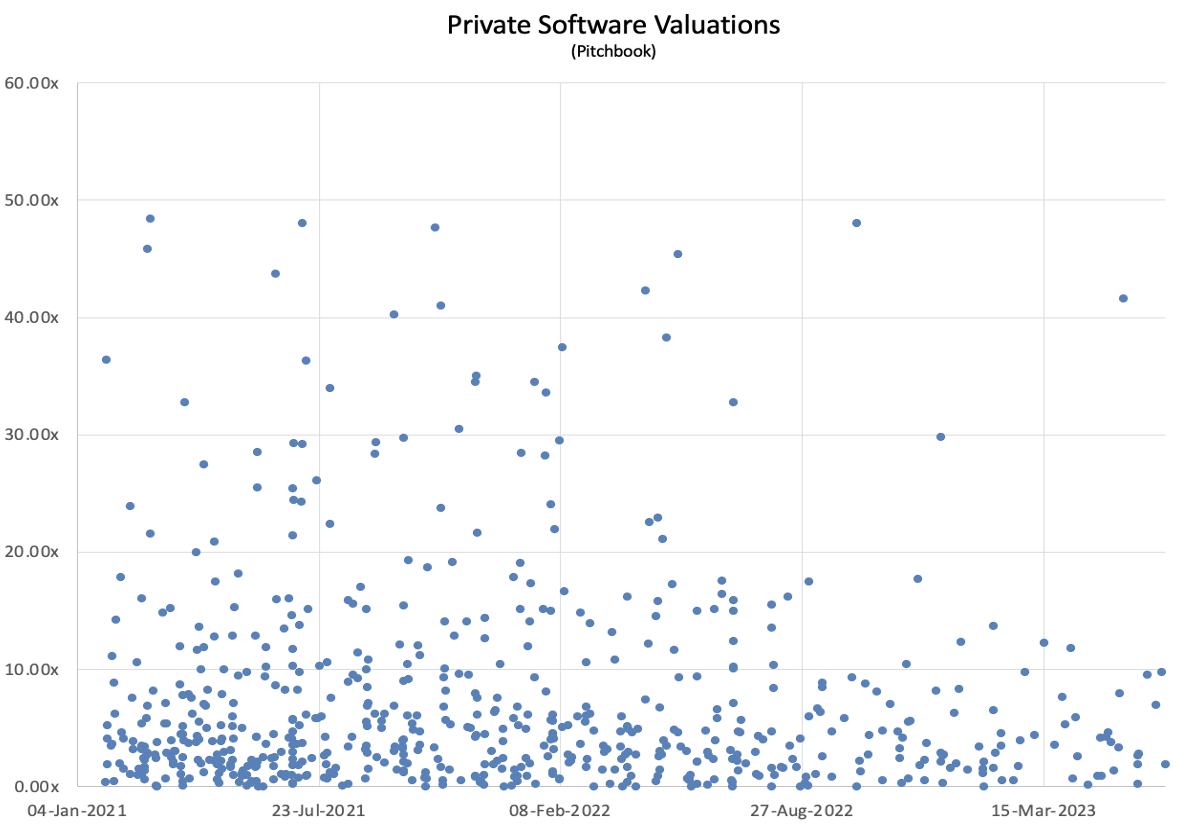

As indicated in the chart below, UBP company growth rates declined 15% in Q3, while subscription growth rates declined a stunning 27% compared to the same period in the prior year.

This may be noise in the data; however, the difference between the two growth rates suggests something more fundamental.

Two things are happening. First, while NRR declined more for UBP companies in the quarter, it was still slightly higher in absolute terms, supporting continued growth. NRR alone, however, does not explain why UBP company growth held up so much better.

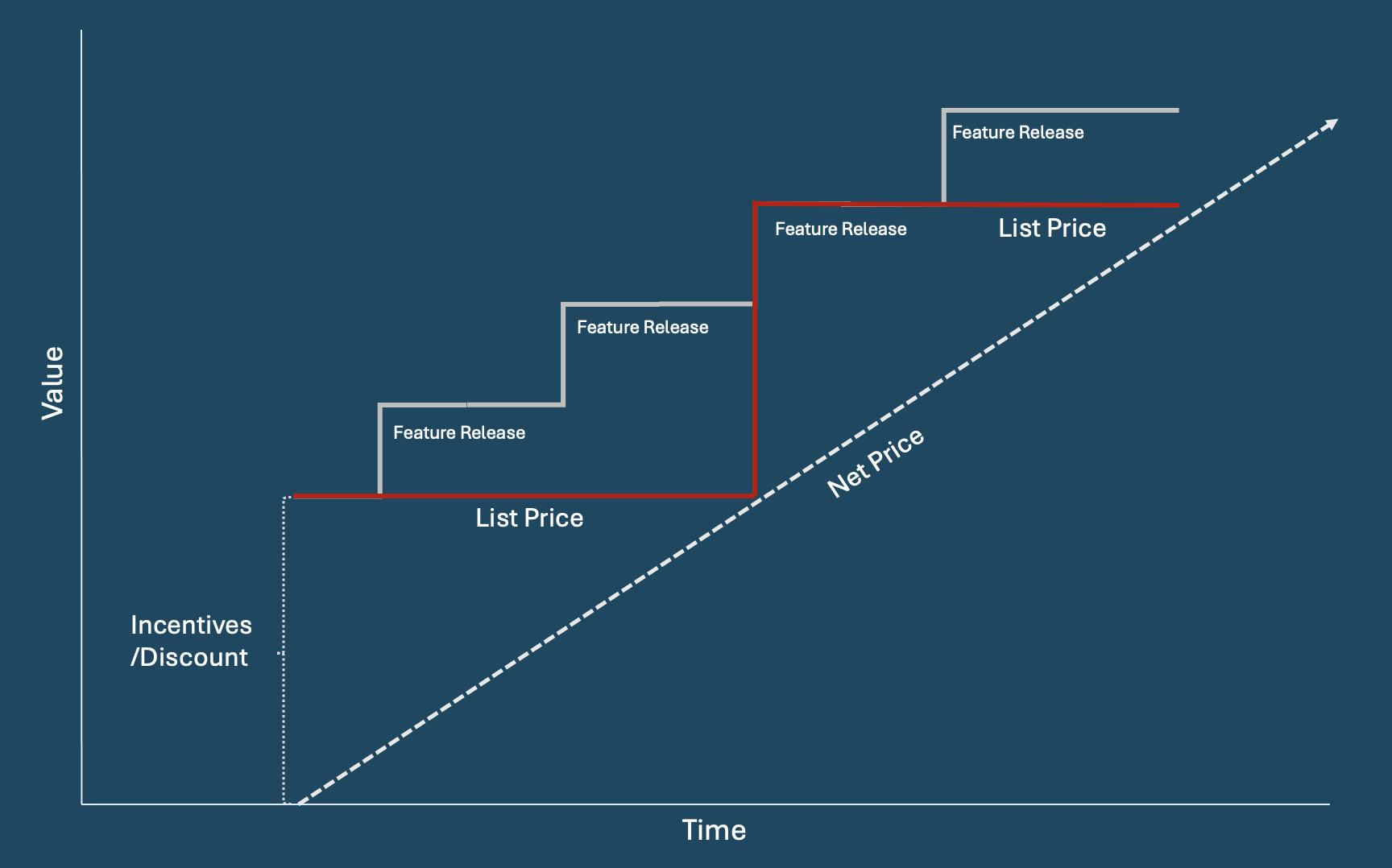

The only other source of SaaS revenue growth is new bookings. And it stands to reason that UBP companies have an easier time booking new business in this more challenging environment. Hesitant to make fixed commitments, buyers are opting for variable pricing. Commonly coupled with product-led growth, buyers may also lean toward smaller, easier-to-adopt solutions with less financial and operational risks.

As I have pointed out frequently, UBP is not a panacea and is not a good fit for many SaaS companies. That said, and counter to common beliefs, the pricing approach has a silver lining regarding cyclicality. Higher absolute levels of NRR combined with lower adoption risk make UBP a solid pricing strategy in an economic downturn.

I will update these numbers for Q4 when available to see if the trend holds up.