For the 58% of SaaS companies that bill their customers annually in advance, revenue growth creates a cash flow windfall as bookings, billings, and collections outpace recognized revenue. With this growth, deferred revenue builds, and the cash burned by an unprofitable company is considerably less than the P&L would indicate.

This is not new news, and it’s why more and more SaaS companies are billing annually in advance.

When bookings slow, however, the extra cash generated by advance billings decreases, and if bookings and revenue flatten or decline due to churn, the process reverses itself. In these cases, the P&L will tell a more positive story than actual cash flow as deferred revenue is “consumed,” and the company generates cashless profits.

With sales cycles lengthening, churn increasing, CFO surveys predicting a recession, and cash balances shrinking, it’s essential to understand how cash flows differ from the P&L when a business slows or shrinks revenue.

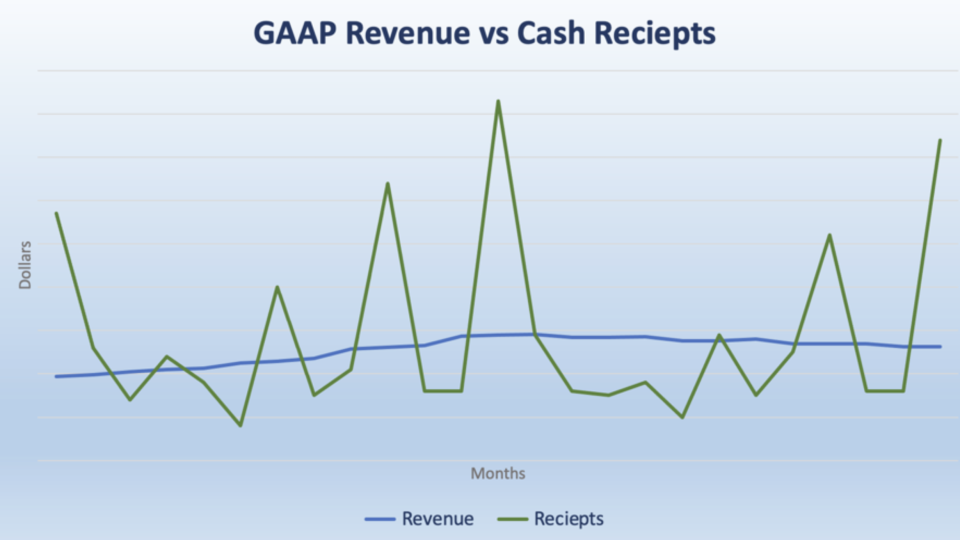

The chart below shows a SaaS company’s revenue and cash collections over two years. In the first year, the company grew MRR by 55% and had net retention of 85%. In the second year, bookings slowed, retention decreased to 83%, and MRR declined slightly. This is a relatively abrupt slow-down for illustrative purposes, but it’s not unreasonable.

In this illustration, the SaaS company recognized revenue of $307,000 during the first 13 months while it collected $402,000 in cash. That is a significant 30% boost in cash collections over revenue. Over the next 13 months, however, revenue was $356,000, while cash collections were lower at $344,000. Separately, if customers were to slow their payments by 30 days, which is entirely possible in an economic slowdown, the cash collected would be even lower at $315,000. Lower cash collections translate into higher cash burn, although it does not show up on the P&L.

This phenomenon is particularly relevant when lowering projected growth in a cash forecast. Lower projected revenue will create higher cash burn on its own, but the negative cash impact of higher losses will be exacerbated by the working capital slow-down described above.

The chart also shows that cash collections are much more variable than revenue. As in a boat, a rocky bottom does not matter when the water is deep, but as the water gets shallower (cash runs low), the rocks matter.

Billing annually in advance is an effective cash management benefit to thousands of SaaS businesses; however, investors and managers should be aware of the downside of the practice when revenues slow or shrink.