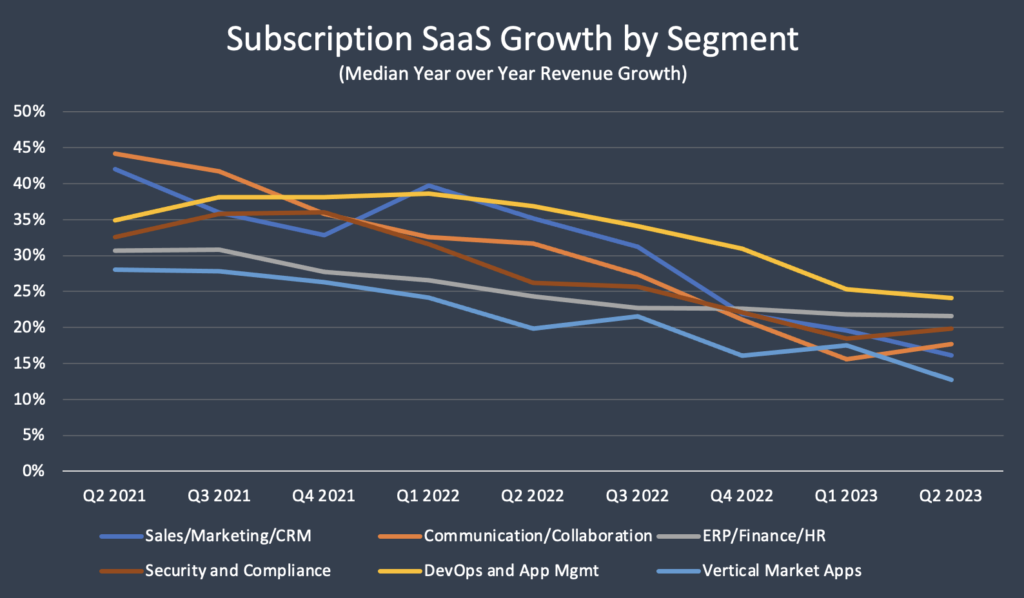

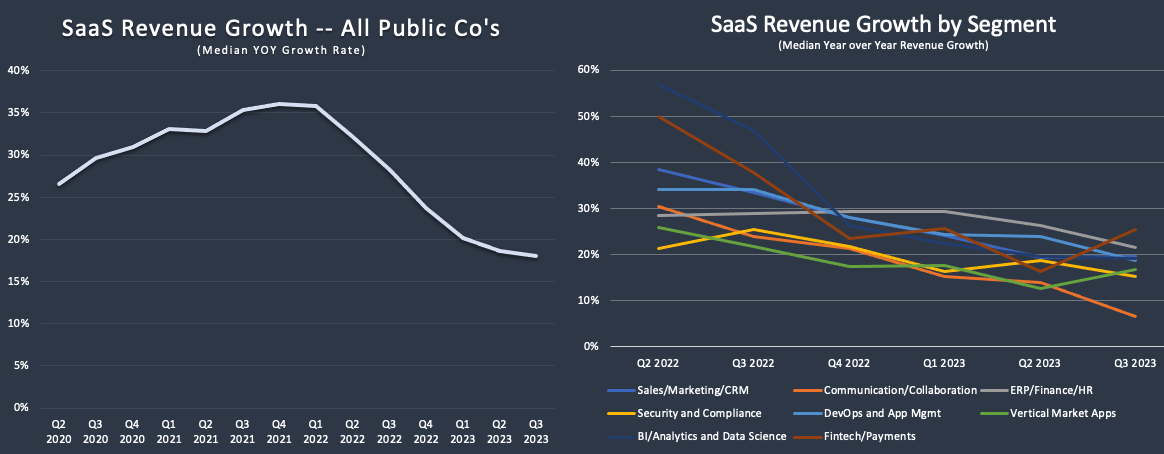

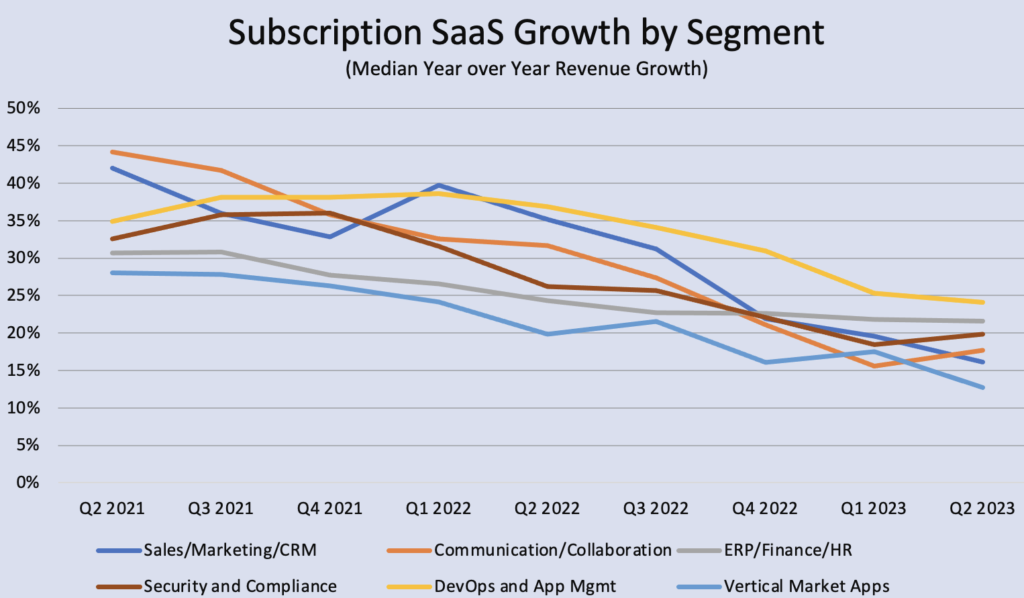

Revenue growth in all segments of the public SaaS landscape has hit the brakes in the last 24 months. Stay tuned for Q3 numbers coming soon.

David Spitz and I developed the segmentation displayed in the graphic and details on specific company assignments are in the comments section below. The graph excludes the volatile Fintech/POS/and Data Analytics segments, which I discuss separately.

The variability in growth between the segments was lower than I expected. Selling HR software to small businesses is much different than selling security software to the enterprise, yet all segments moved together. It’s a reminder from my SaaS Capital days that the following comment is almost never true. “Our SaaS solution is counter-cyclical because…blah blah blah.”

For predominantly subscription-based models, back-office solutions held up the best. ERP, Finance, and HR companies, along with DevOps and App Management, saw growth rates decline 30% in the last 24 months, while growth in front-office applications (including Sales, Marketing, Communication, and Collaboration) is down 60%. The back-office now represents the two fastest-growing segments. Presumably, churn played a role here. Companies can’t cancel their ERP and HR systems, but it’s not hard to let go of one of the dozens of marketing applications.

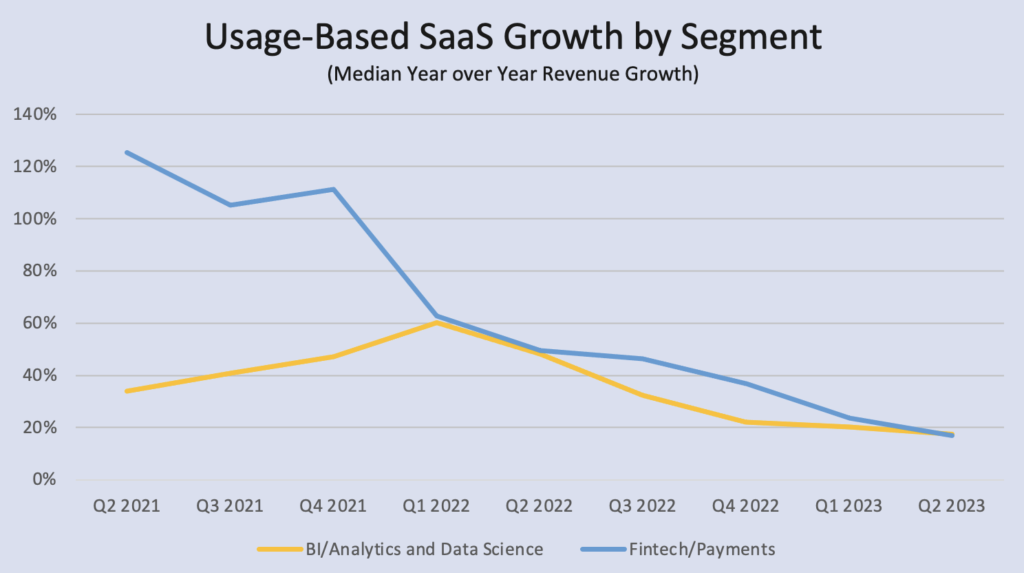

Not surprisingly, usage-based revenue models and those with hyperbolic pandemic growth have had growth decelerate the most. POS and Fintech surged during the pandemic as businesses needed an online commerce option, but growth has now plunged from 125% in Q2 2021 to 17% in Q2 2223. Another predominantly usage-based revenue segment, “BI/Analytics and Data Science,” has also cooled off in the last 15 months, with growth down 70%. It will be interesting to see if the e-commerce decline levels off soon and how AI will impact the data analytics space in 2024.

Two segments saw growth rates improve in Q2: Communication and Collaboration and Security and Compliance. Also, Maxio Institute data for private companies also showed an uptick in growth in Q2. We will know shortly if it carries through to other segments in Q3. Third-quarter data for most public SaaS companies will come out over the next few weeks, and I will update this analysis once reported.

Thanks again to my collaborator, David Spitz.