It’s time to pick a lane — growth or profit. Below is a framework to think through your path forward.

Early in my VC career, I was sitting in a board meeting when Frank Adams, the founder of VC firm Grotech, told the CEO he either needed to grow faster or become profitable; those were the only two choices. I was fresh out of business school and had somehow missed this lesson. I felt like asking for a refund.

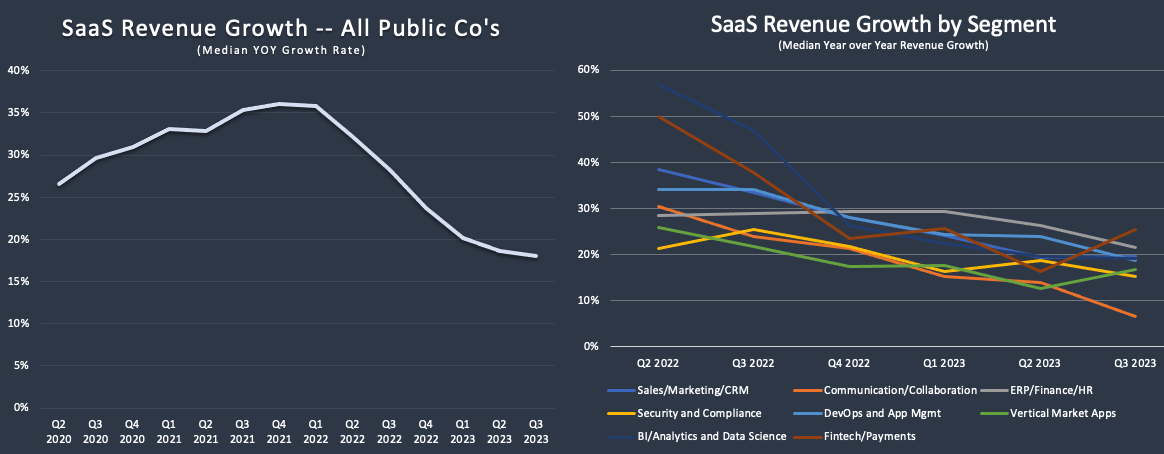

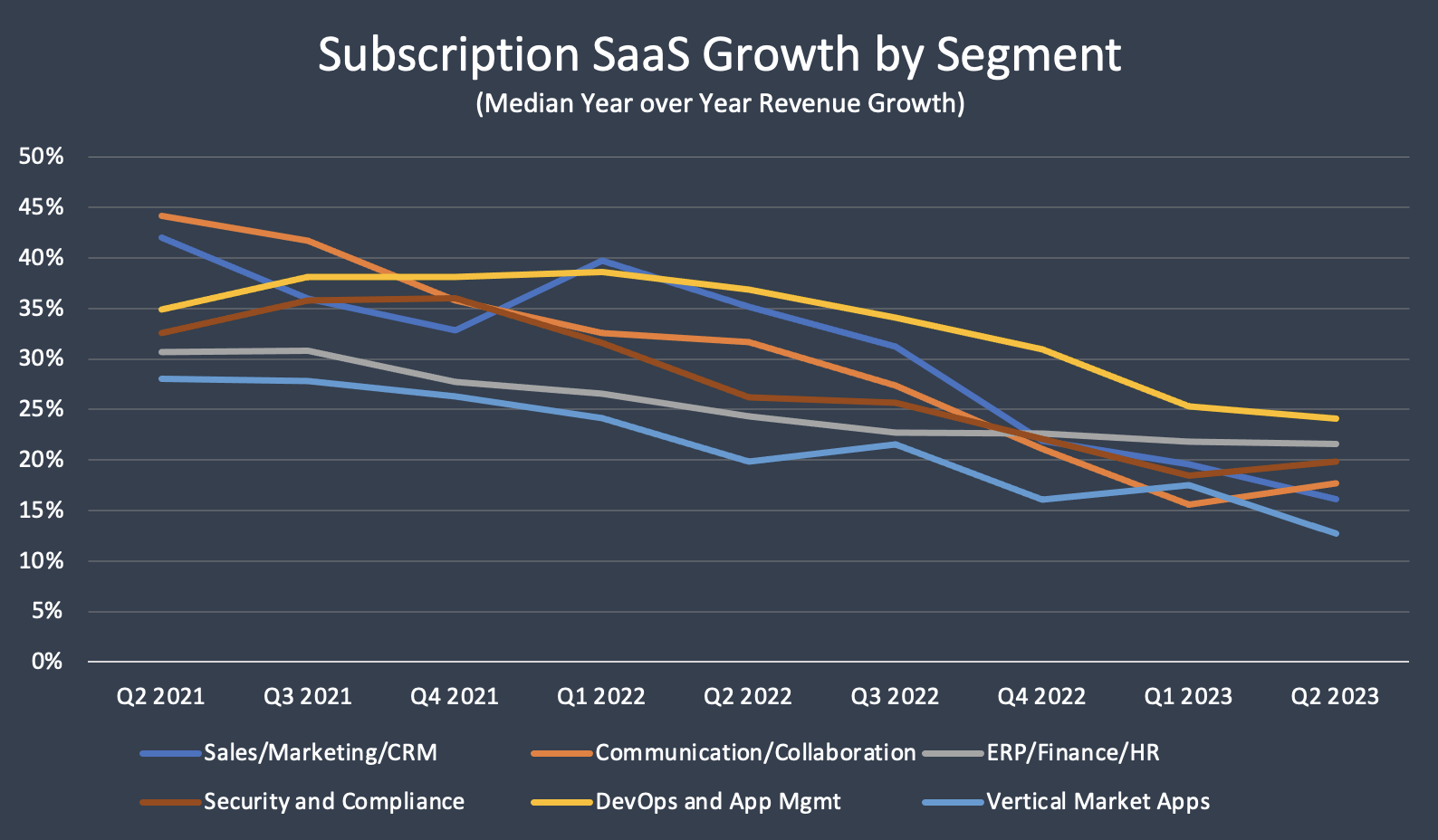

Whipsawed by free money, then no money, all SaaS businesses tightened their belts in the last two years. Some cut expenses, maintained growth, and became profitable, while many cut expenses, saw growth deteriorate, and remained unprofitable. Now, many SaaS companies are in a holding pattern to see what’s next in the funding environment and economy.

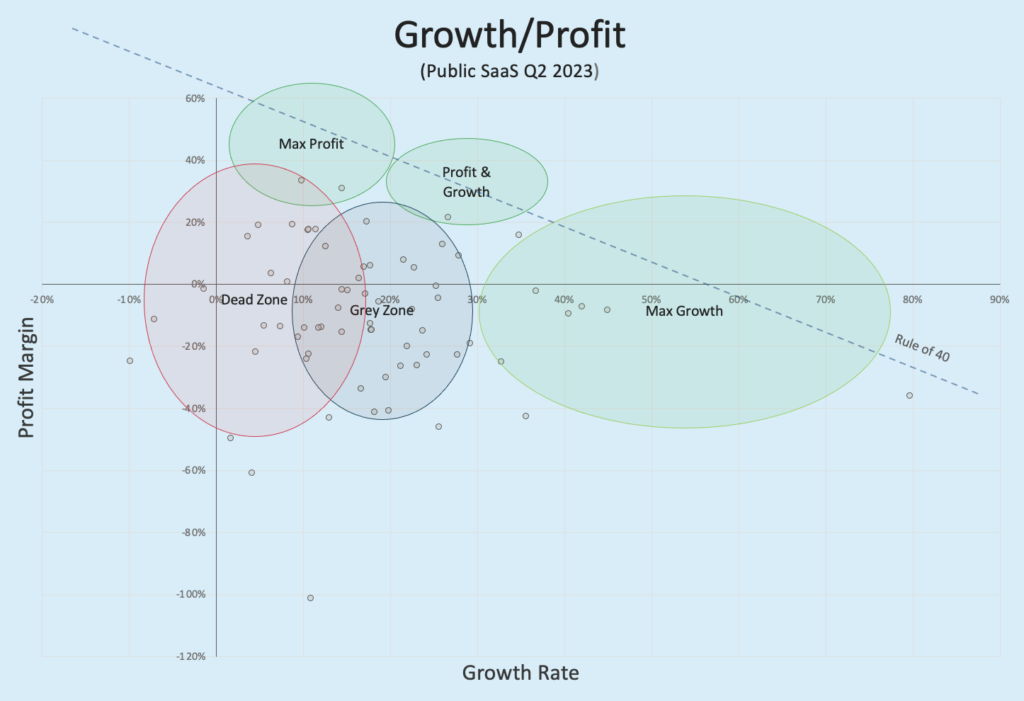

In the public markets, many companies are in the Dead Zone and Grey Zone on the chart — slow growth and low profits. They must find a path up, to the right, or both. Hanging out in the Dead Zone is risky and destroys value, especially when interest rates are high.

Choosing between profit and growth is not easy, but it’s not overly complex. All SaaS companies can be profitable, and the one question you need to answer before picking a lane is:

Is there an objectively reasonable, data-driven, and fully funded plan to re-accelerate growth?

If not, the business needs to start making money. Now. Recurring revenue, high gross margins, and discretionary expenses are the ingredients of profitability.

Getting to breakeven is the first step. Breakeven allows more time to identify incremental growth plans. But there are risks in staying in the slow-growth and break-even position for too long. In addition to opportunity costs, technology risks, economic risks, and competitive threats can quickly turn slow growth into decline.

Once in the profit lane, target operating profit of at least 20%, which is the median for the Max Profit group of public companies. Why 20%? This level of profitability generates an acceptable valuation on an EBITDA basis and allows for a sale, re-cap, or M&A strategy, as it can support leverage that is attractive to PE firms.

Circling back to the growth lane question.

“Objectively reasonable” is a filter designed to emphasize clear thinking. This is not a test of will or grit; it’s an “objective” exercise, and “reasonable” is the bar to be cleared.

“Data-driven” means the growth plan needs to be based on things like successful go-to-market experiments, early adoption of a new product, or a successful cross-sell program. These plans should not be based on a “good pipeline” or an “amazing” new VP of Sales.

And finally, “fully funded.” If the growth plan requires capital, and there is none, it’s not helpful, and a capital raise becomes the critical next step.

This post is designed to focus SaaS founders and executives on the binary nature of value creation. It’s possible to survive with slow growth and weak profits, but not for long.

It’s time to pick a lane.