A Pricing Framework

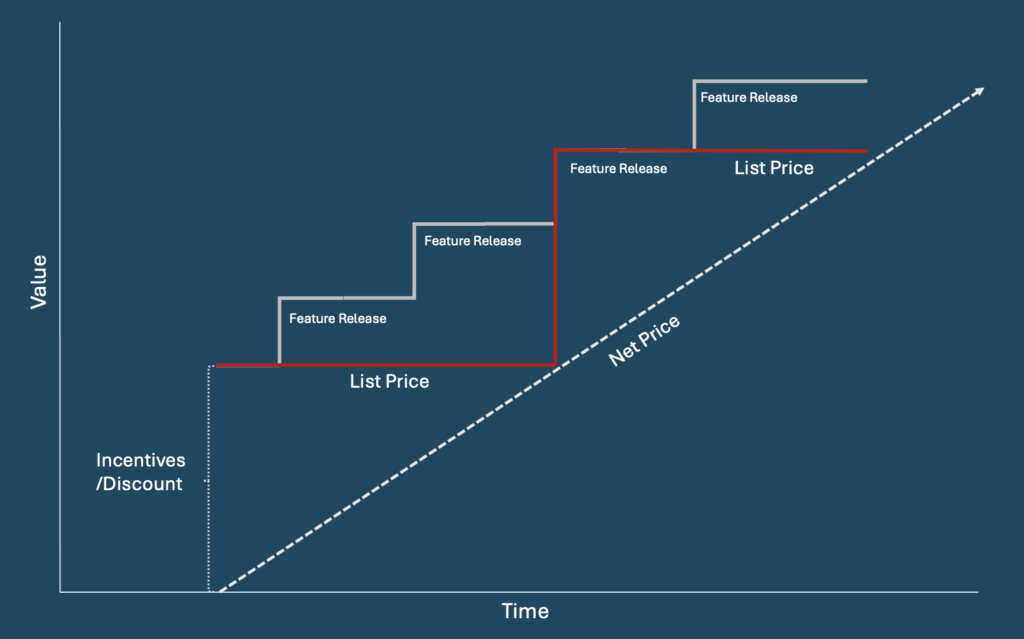

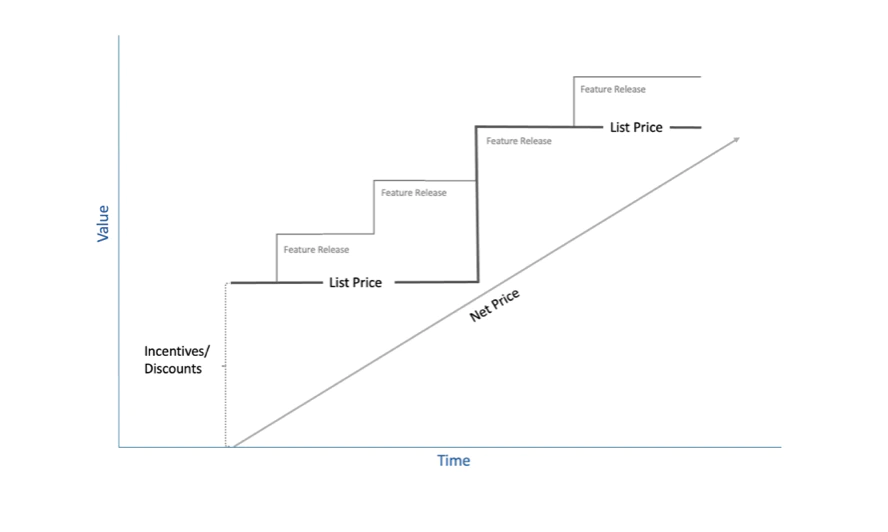

Before you can validate pricing, you need to set pricing. Chris Mele, the Managing Director of Software Pricing Partners, described a comprehensive approach to helping ensure software pricing is always near the maximum customers will pay. SPP calls this approach Continuous Monetization, but I like to think of it as the “Stair and Escalator” approach, laid out in the graphic below. Combined with a robust feedback loop, this methodology can consistently keep prices near their optimal level.

The small stair steps are increases in value a customer receives from new product releases or service offerings. As you can see, after a few small steps in value, the list price then steps-up as well – typically on an annual basis.

The diagonal line under the steps is the escalator and represents the net price offered to customers. The difference between the list and net price is the discount amount which is adjusted constantly. There are many different types of incentives you can offer when calculating the net price so for now we’ll just call them all the discount amount. Discounts are highest right after a list price increase, and they get smaller as time passes. The net result is a gradually increasing net realized price which approaches the list price just prior to a list price increase.

This methodology applies to per-seat pricing, hybrid pricing, and pure consumption pricing. In consumption pricing, list price increases might include the introduction of entirely new pricing metrics. The new metrics would receive substantial, although structured, discounting upon introduction, with those incentives diminishing over time.

Rather than trying to discover a magic price point upfront in some sort of study, this process focuses on treating all pricing decisions as hypotheses to rigorously test and validate (next section) in the marketplace with real-world data. This is a broad, conceptual approach to overall pricing which will be deployed with specific packaging and discounting rules.

Executing this framework requires pricing discipline. If your organization lacks pricing discipline, changes in list price will be offset by ever-higher discounts, and the net realized price will not increase. The article Pricing Chaos will help identify and address pricing discipline issues in emerging SaaS businesses.

Over time, according to Chris, the outlined approach will move pricing to the upper boundary of your pricing envelope, with the goal of “slightly uncomfortable” prices to customers. This doesn’t mean you have to be the premium-priced player in your market. It does mean that it’s okay for customers to describe great value as well as a significant investment. If customers are entirely comfortable with the price they are paying while still describing substantial value, you are likely leaving money on the table.

That said, it’s essential to know if you are crossing the line and over-pricing your product. The trick is to optimize the price such that it doesn’t introduce unnecessary new sales or renewal friction into the process. That is where ongoing feedback is critical to this process.

There are three sources of pricing feedback; customers, prospects, and salespeople.

Talk to Your Customers

Obviously, one of the best ways to understand pricing is to chat with your customers. But which ones, and how many? Nick Zarb, a partner at the leading pricing consulting firm Simon Kutcher, recommends not getting too caught up in how many customers to talk with but instead focusing on a few friendly customers in each pricing segment. Nick commented,

Typically, within just ten customer interviews, you will start to see convergence on whether a particular pricing strategy does or doesn't work for a particular segment."

Further simplifying the process, segmentation for pricing does not need to be as granular as segmentation for sales and marketing. Chris Mele sees pricing segments as supersets of existing segmentation called “classes”, with many different types of buyers falling into the same pricing bucket regarding value proposition and willingness to pay. Look at your existing customer segmentations and see which ones can be consolidated for pricing feedback.

What to Ask Your Customers?

“What’s the most you would pay for this product?” is what you want to know, but this is not the question you ask, at least not initially. Instead, the pricing discussion should be an exploration of benefits, value, and fairness. Nick suggests,

When asking customers about the value of any features or functionality, reword simple descriptions into benefit statements, else you risk customers not understanding the value and indicating a lower willingness-to-pay."

Nick and Chris differ in opinion about asking directly how much a customer would be willing to pay. However, according to Nick, if you ask the question directly, it should be the last thing you ask after clearly exploring the value the product delivers. Limiting the number of features and benefits you ask about is also important. Nick thinks you can test no more than ten or so features at one time.

Chris and his team have found that customers do not inherently understand what they are willing to pay for products and services and their willingness to pay can change as they imbed your software more deeply into their operations. Chris described a complementary line of questioning focused on how “entangled” customers have become in your solution. For example, understanding your solution’s direct APIs, indirect data movements, and non-core beneficiaries helps quantify your customer’s perception of value along with their switching costs. You can gain substantial insight into future pricing discussions by asking these straightforward questions.

Who Should Be Asking the Questions?

Your employees should be talking to your customers, but you may consider engaging consultants to approach your prospects and competitor customers. It is sometimes difficult to get candid feedback as an application vendor.

Opinions differ on “secret shopping” your competition. However, the author and SPP believe it’s virtually impossible to call (or hire someone to call) your competition and ask them about pricing without crossing into unethical and potentially illegal territory. On the flip side, SPP suggest implementing techniques to avoid being mystery shopped by your competitors.

Talk to Your Salespeople

Pricing should be an ongoing conversation with the sales team to solicit marketplace feedback and hone sales processes that deliver the best net price. In addition to weekly discussions on pricing, Chris Mele suggests listening to actual sales calls so you can better ascertain the difference between pricing strategy and sales execution. Listening to calls provides an unvarnished marketplace narrative essential to understanding pricing resistance. In terms of implementing sales strategies, Nick suggests,

Identify those salespeople that consistently achieve the highest prices and turn their strategies into training for the rest of the team."

How Often Should I Monitor Pricing Feedback?

All the time. Continuous feedback is critical to staying within the optimal pricing zone when executing the Stair and Escalator approach referenced earlier. Episodic efforts are not timely enough to understand whether pricing aligns with the market. Underpricing is one of the most value-destroying mistakes a software business can make while pricing it too high can cause long-term damage. Untimely feedback from customers, prospects, and salespeople will increase the likelihood of making pricing mistakes in either direction.

What About A/B Testing

Direct A/B testing can be effective for low ACV products but not in an enterprise sales environment as we have been describing. This is because enterprise customers will compare pricing with each other (entire LinkedIn communities are dedicated to comparing software product prices) and arbitrary pricing differences will be discovered and generate distrust which will manifest itself during the sales process or at renewal time.

Chris Mele is not a fan of A/B testing for B2B software companies in all of its forms. Chris comments,

Regardless of sales channel, region, high ACV or low, our data over the past 4 decades clearly shows people compare net prices—period.

How would you feel—and more importantly what would you do—once you found out you were in cohort B and paid double?”

Customer Advisory Boards

There are many best practices published about CABs which I will not duplicate here but rather emphasize that they can provide timely, candid, and in-depth feedback on various topics, including the product roadmap, positioning, and pricing. Some experts even suggest setting-up CABs before launching the product.

What To Do If Your Pricing Is Wrong?

If you determine your pricing needs to be lowered, Chris suggests never cutting the list price. That is a marketplace signal that will cause issues for years to come. If you find yourself overpriced, hold the list price while you roll out new value-added features and lean more heavily into discounting in the near term—or launch new offers at a lower price with limited features. Underpricing is easier to fix, but don’t try to close a significant gap all at once, and always tie list price increases with the introduction of more value in the product.

About the Experts:

Chris Mele is the Managing Director at Software Pricing Partners. For over four decades, SPP has helped B2B software companies monetize their software & services, launch new products and implement monetization as an ongoing process. Chris was also the co-founder and CEO of his own SaaS business, CompanionCabinet Software, and he publishes a fascinating newsletter called The Zookeeper’s Journal. Chris is a graduate of Miami University.

Nick Zarb is Partner at Simon-Kutcher. Nick has focused his twelve years at SKP on helping software businesses optimize pricing, monetize novel innovations, and develop go-to-market strategies. Nick is a graduate of The University of Oxford.

About the Author:

Todd Gardner is the Managing Director of SaaS Advisors and the founder and former CEO of SaaS Capital. Todd was also a partner in the venture capital firm Blue Chip Venture Company and was a management consultant with Deloitte. Todd has worked with hundreds of SaaS companies across various engagements, including pricing, capital formation, M&A, metrics, valuations, and content marketing. Todd is a graduate of DePauw University and Indiana University.